are union dues tax deductible in nj

Answer No employees cant take a union dues deduction on their return. A reminder for tax season.

Deduct Your Union Dues From Your New York State Income Taxes Hotel Trades Council En

As part of tax reform unions due to deductions will no longer be allowed.

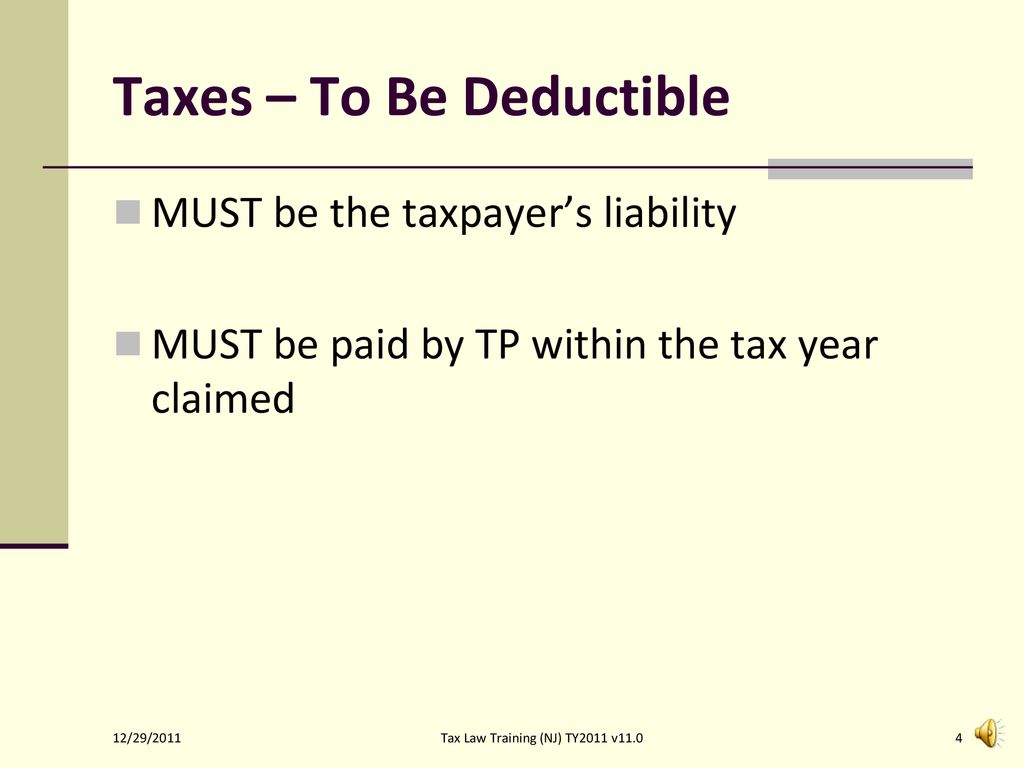

. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed. You can deduct dues and initiation fees you pay for union membership. Dues and any employee expenses not itemized by an employee are no longer tax-deductible.

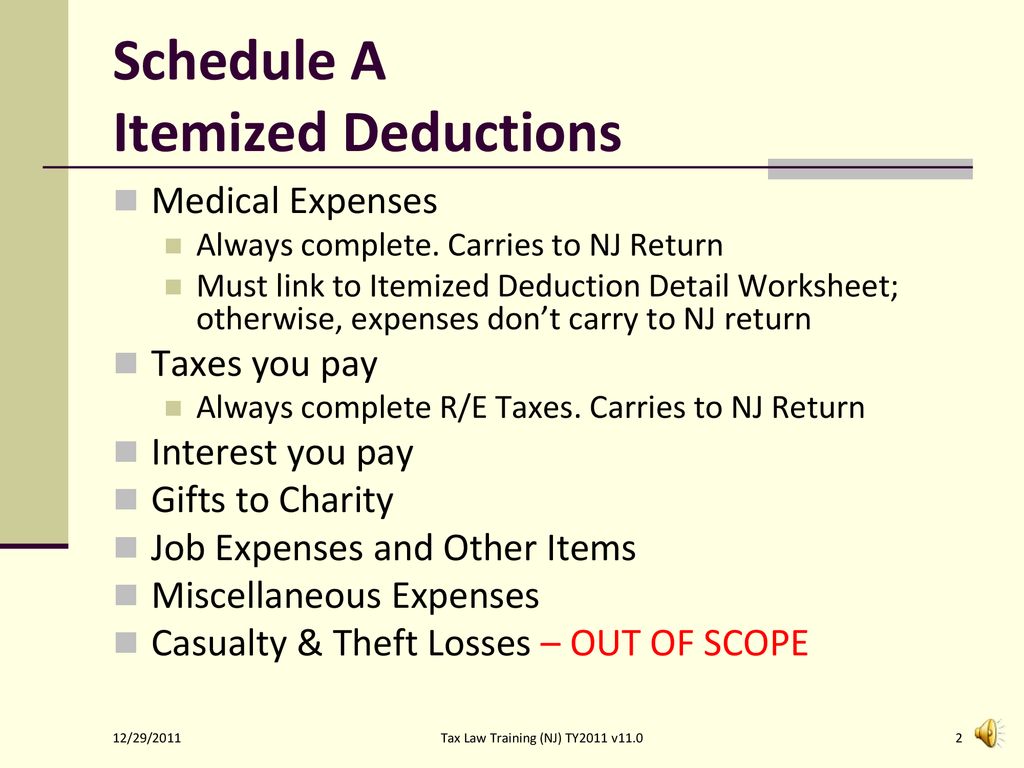

These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized. But if you took the itemized deduction NJ taxes health insurance premiums so they can be itemized in your NJ return as. Because of the recent Supreme Court ruling in Janus v.

The bill the House passed would allow union. Dues 250 General Professional Membership Any person engaged in any professional education capacity in New Jersey who is self-employed employed in a private or parochial school. UNION DUES CANNOT BE DEDUCTED FROM GOVERNMENT EMPLOYEES IN New Jersey WITHOUT CONSENT.

Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union. Public sector employees including nonmembers who paid agency fees as of June 27 2018 may still decide to become a dues paying union member. Find your annual union dues payment.

The Act also sets forth that an employee may only revoke prior authorization for the union to deduct fees from the employees paycheck during the 10 days following the. If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit. However most employees can no.

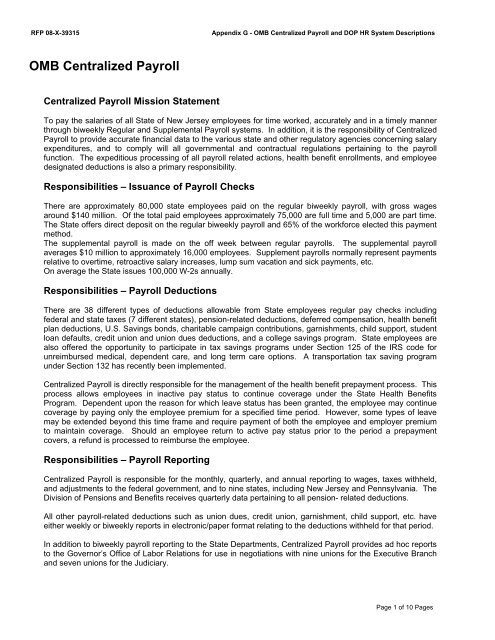

California along with other states including Pennsylvania and New York already allows union members to lower their taxable income by the amount of their union dues through. Two years ago the New York State AFL-CIO along with unions across the State of New York fought for legislation that would allow union members to deduct union dues on state income. The employees net pay is then reduced by any post-tax deductions including union dues donations to charity wage garnishments etc.

However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that. Full-year residents can only deduct amounts paid during the tax year. Union members may still.

To claim the union dues tax deductions for 2017 and prior tax years you must itemize your expenses on Form 1040 Schedule A. NJ requires you to take standard deduction if you did so federally. Part-year residents can only deduct those amounts paid while they were New Jersey residents.

Join The Union Here Union Of Rutgers Administrators American Federation Of Teachers

New Jersey Military And Veterans Benefits The Official Army Benefits Website

April 15 Won T Be Tax Day This Year Here S How Much More Time You Ll Get Nj Com

April 15 Won T Be Tax Day This Year Here S How Much More Time You Ll Get Nj Com

How Will The Change In The Tax Laws Affect The Individual Taxpayer

Union Dues No Longer Deductible Under New Tax Law Don T Mess With Taxes

Notes Handouts Pub 17 Chapter 21 Through 29 Pub 4012 Tab 4 Ppt Download

Deducting Union Dues H R Block

Omb Centralized Payroll And Dop Hr System

Public Employees Alaska Policy Forum

New Bill Would Restore Tax Deduction For Union Dues Other Worker Expenses

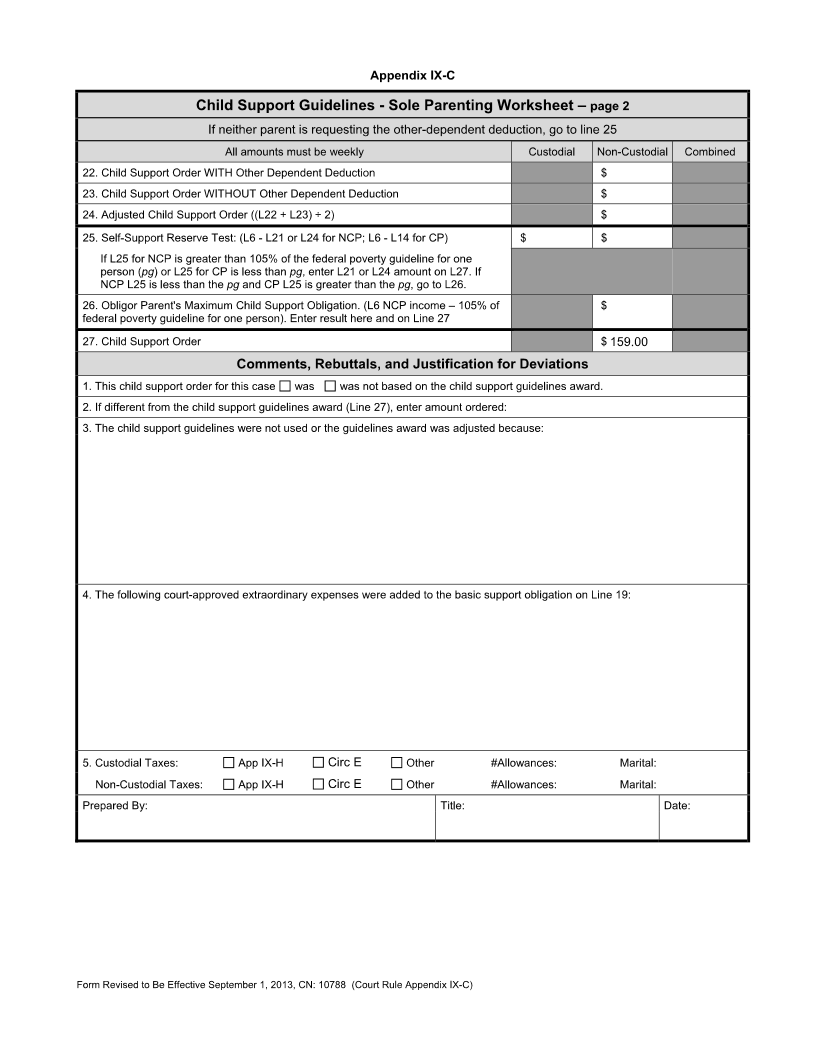

New Jersey Child Support Worksheet

Notes Handouts Pub 17 Chapter 21 Through 29 Pub 4012 Tab 4 Ppt Download

Union Dues Are Now Tax Deductible Foa Law

It S Tax Time Remember Union Membership Dues May Be Deductible Nteu Chapter 280 U S Epa Hq

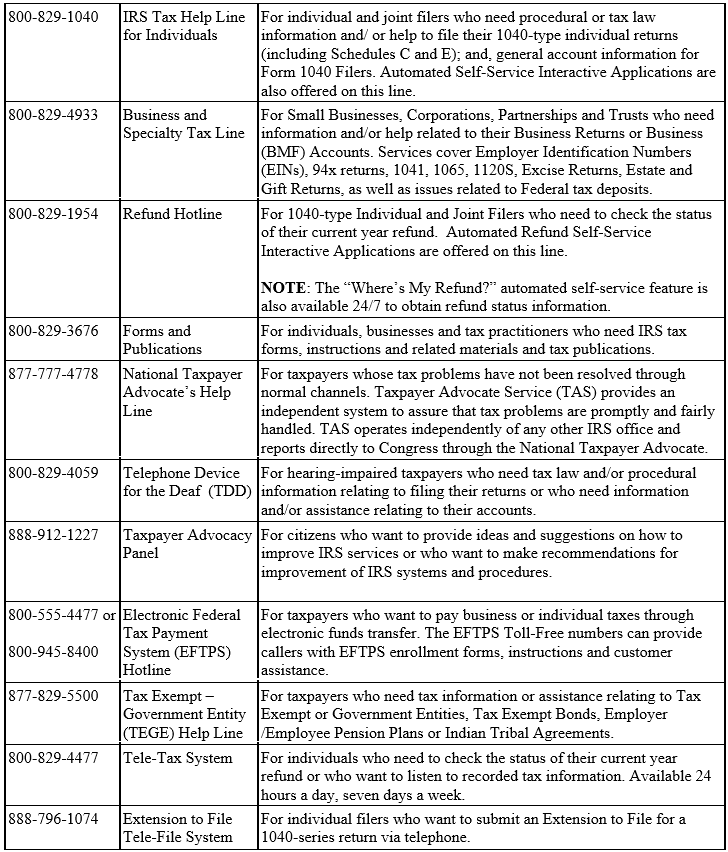

Irs Criminal Investigations In New Jersey

Tax Deductions The New Rules Infographic Alloy Silverstein

Stateaidguy Sure Njea S Powerful But Nj Teachers Don T See Much Benefit In Their Paychecks Nj Education Report